Car Insurance Schedule

For example some states require drivers to purchase 100000 worth of liability coverage per accident while others require just 20000 or 30000 of liability coverage.

Car insurance schedule. Scheduled personal property and canine liability exclusion. Plans available for some providers include partial payments automatic drafts and full annual payments. Policy schedule is also known as a schedule of insurance. Two of the most common types of schedules have to do with add ons and exclusions to the basic renters or homeowners policy.

To deduct car insurance as a self employed person or single member llc youll use tax form 1040 schedule c. Your insurance schedule is an important document that sets out the information youve given us on which weve based our decision to insure you as well as the individual details of your policy. All excesses are displayed on our car insurance policy schedule. Paying for car insurance can be stressful for many people.

Asked march 22 2014 in. It is the part of the insurance contract that identifies the policyholder and details the property and persons covered the amount of coverage the exclusions the deductibles and the payment mode and schedule. Depending on your situation one method may work better for you than another. Unless they are listed on your car insurance policy we are unable to provide any information nor can they action any requests on your behalf.

The policy booklet schedule motor proposal confirmation and certificate of motor insurance. Win 100 amazon gift card by taking our 2 minute reader survey. Each state has specific requirements for the type and amount of car insurance coverage that drivers must carry. Calculate your car insurance and other operating expenses using the above method.

There are many types of insurance schedules from additional people covered on your policy to types of windstorm damage your insurer cant cover and even coverage for different types of mold seriously. Figure your deduction by adding your home expense deductions including the qualifying portion of your house insurance to your other employee business expenses on line 21 of schedule a. Can you deduct auto insurance on schedule c. Write the total amount on schedule c line 9.

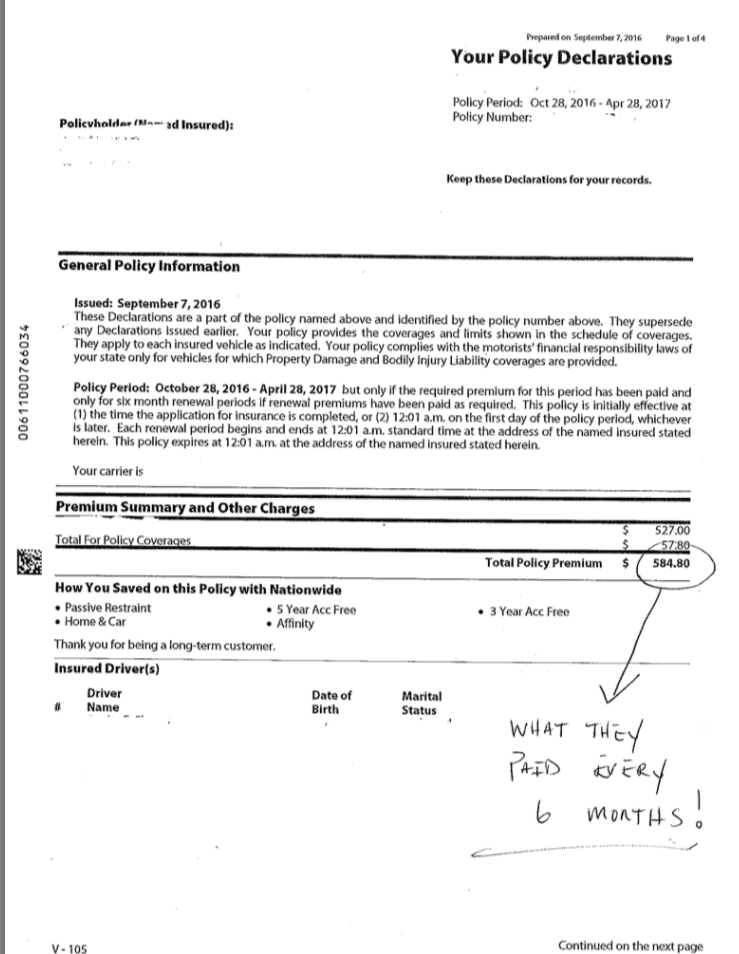

Keep detailed records of mileage and expenses if you need to prove your deduction later. 37376 points contact me. Schedule the document which identifies the policyholder and sets out details of the cover your policy provides.