Vehicle Insurance Car Insurance Policy

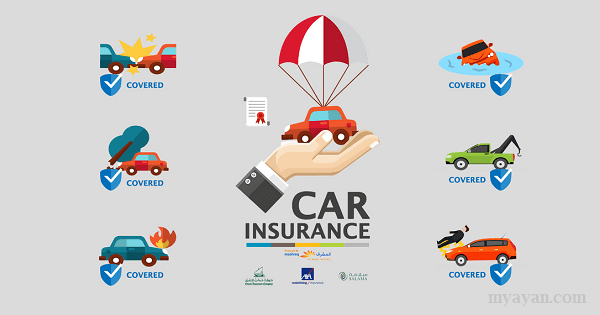

A car insurance policy is a type of vehicle insurance that offers comprehensive protection to the insured car in case of damages due to natural and man made calamities.

Vehicle insurance car insurance policy. It prevents the car owner from incurring any monetary losses resulting from unpredictable incidents including accidents damages suffered on the insured car. Vehicle insurance also known as car insurance motor insurance or auto insurance is insurance for cars trucks motorcycles and other road vehiclesits primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. State liability limits are typically low. Vehicle insurance may additionally offer.

Temporary car insurance or short term car insurance is for when you will only require insurance on a car for a short period of time due to a variety of circumstances. In india almost all general insurance companies both state owned and private offer auto insurance policies. Well also ask you a few questions about your driving history. Car insurance is required mainly for the following reasons.

In recent times these vehicle insurance policies can be assessed and purchased online thereby making the process more simpler and approachable. A comprehensive car insurance policy is a cover under which the insurance company is liable to pay for damages caused to third party property and life including death by the insured car as well as for the damages incurred by the insured vehicle. To purchase a policy youll need your vehicle identification number vin handy. A severe accident can easily exceed the limits of minimum auto insurance policies leaving personal assets of the car owner at risk.

You can select higher than required liability limits pad your policy with optional coverages like comprehensive and collision and add extra services like towing and labor or rental car coverage. Compare buy renew vehicle insurance plans online from 20 motor insurers in india and save up to 80. The insurance industry recommends bodily injury liability coverage of 100000 per person and 300000 per accident and property damage liability of 100000. A third party liability policy is compulsory for all vehicles but you can decide to go for a comprehensive car insurance policy too.

You can quote online or call us at 1 855 347 3749. Ready to get started. Comprehensive car insurance policy. Get the best motor insurance premium quotes for a car and two wheeler at policybazaar.

It insures your car from road accidents theft natural. Auto insurance protection against financial liabilities from accidents. To get the most accurate quote youll need to know your cars make model and year.