Third Party Car Insurance Online Lowest Price

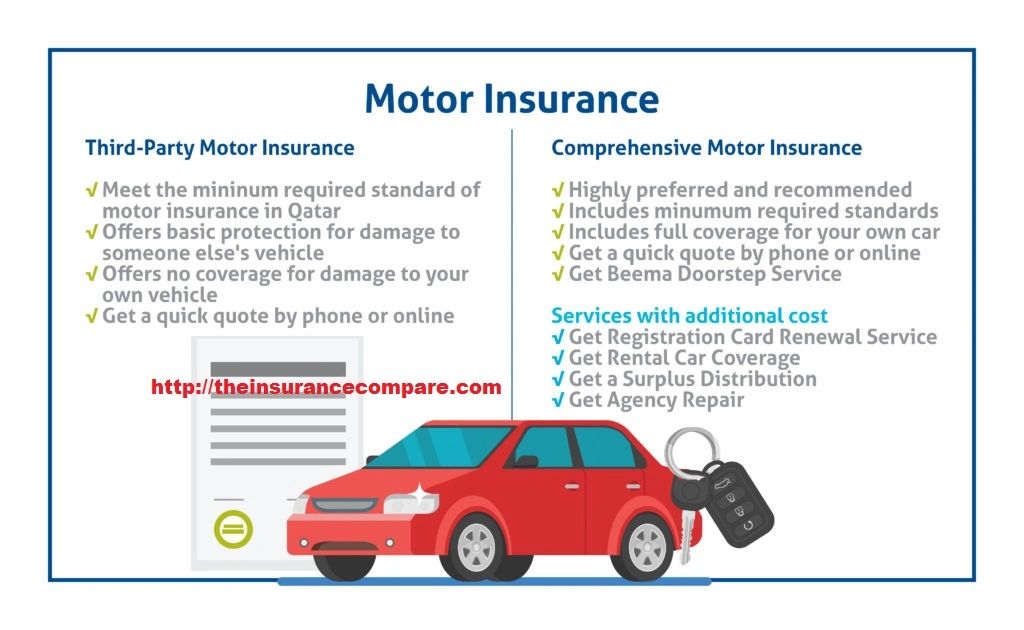

Third party insurance covers damage caused by the use of your car to someone elses property or vehicle.

Third party car insurance online lowest price. For third party fire and theft 50 of people could achieve a quote of 1040. But for a fully comprehensive policy 50 of people could pay 654. Third party insurance premium for private cars less than 1000 cc. Third party car insurance is often double the price of a fully comprehensive policy.

Third party motor liability insurance policy is necessary in india as per section 146 of the motor vehicle act 1988. 094444 48899 customer service. Based on our latest data 50 could achieve a quote of 1825 for third party car insurance. 75200 more than 150cc but less than 350cc.

National car insurance earned a net premium of rs500823 crore in fy 2017 2018 with an incurred claim ratio of 12167. So always compare because you could get more cover for less money. 119300 more than 350cc. 48200 more than 75cc but less than 150cc.

National car insurance. United india car insurance offers a third party car insurance policy comprehensive car insurance policy and a personal accident cover as well. 207200 more than 1000cc but less than 1500cc. It secures you against the legal liability emerging from your vehicles interest in a mishap that prompted the damage demise or broad property harm of a subjective outsider.

A number of the car insurance brands on our panel are arranged by auto general services pty ltd acn 003 617 909 on behalf of the insurer auto general insurance company limited acn 111 586 353 both of which are related entities of compare the market pty ltd. When you are at fault the costs of repairing damage or replacing a third partys property could be high so third party property damage insurance covers you for up to 20 million. If the third party car insurance plan has coverage for personal accident the premium for such cover would be added to the plan. Rs7 890 rs100 rs143820 rs9 42820.

Find out why third party cover is so expensive and compare car insurance quotes now to get the cheapest price for your preferred type of policy. The premium is for the third party coverage which covers third party bodily injury and third party property damage. Say you have a car whose engine capacity exceeds 1500 ccsince the third party car insurance since the third party premium includes cover for personal accident liability too you would be paying the below premium. 322100 more than 1500cc.

Basic tp premium personal accident owner driver gst 18 total third party premium in the fy 2018 19.