Hdfc Ergo Car Insurance Claim Settlement Ratio

Hdfc ergo health insurance.

Hdfc ergo car insurance claim settlement ratio. Claim settlement ratio as per public disclosure. This is based solely on the information published by the insurance regulatory development authority of india irdai and is measured on consistently used bases. Hence in case the claim settlement ratio of a company stands at 90 it means that 90 claims out of the 100 filed have been settled. Effective ratio aditya birla health insurance.

Max bupa health insurance. It is recommended that you read online reviews and ask your friends and relatives about their experiences before you make the choice. The information below shows the trend in hdfc life insurance claims settlement ratio for the last 6 years. Hdfc ergo is amongst the top notch car insurance companies in india.

Hdfc ergo general insurance. Hdfc ergo has carved a nice niche for itself in the insurance market. Tata aig general insurance. These should be your preferred companies for car insurance renewal whether you buy it online or through your agent.

Its car insurance policy offers coves third party liabilities as well as loss damage caused to your vehicle in accidents theft fire explosion natural disasters and theft. However it is vital that you do not use this ratio as the only factor to choose your insurer. A claim settlement ratio is basically the ratio of settled claims to the total claims filed in a particular accounting period. Hdfc ergo car insurance.

It clearly indicates that hdfc ergo is in a position to clear claims without having to overburden their finances. Generally a health insurance claim settlement ratio exceeding 80 is considered good. It has successfully emerged as one of the best non life insurance companies among other insurance providers in the private sector. Hdfc ergo health formerly known as apollo munich health insurance.

Moreover it gives unlimited claims settlement in one policy year. Hdfc ergo car insurance claim buying car insurance is mandatory if you have a car. Claims settlement ratios for motor insurance third party liability most claims in india are own damage claims. The idea behind buying this insurance is to ensure a cover against all possible losses resulting from theft or accident.

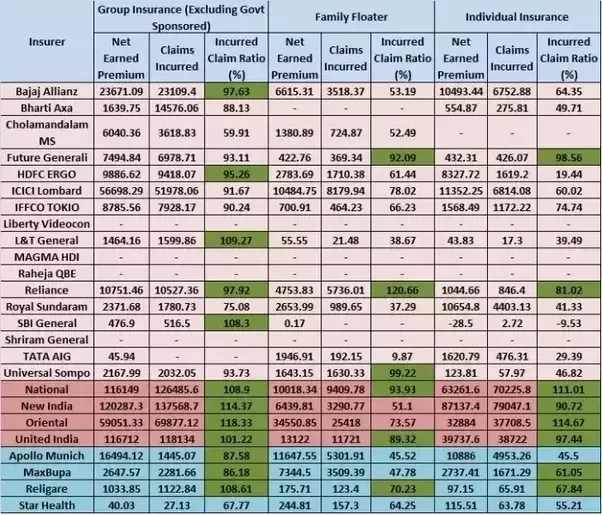

The incurred claim ratio icr indicates the overall performance of insurance companies and gives people an overview of what they can expect from their insurer. Trade logo displayed above belongs to hdfc ltd and ergo international ag and used by hdfc ergo general insurance company under license.