Car Insurance Yearly Cost In India

The car insurance premium is calculated based on the below mentioned formula.

Car insurance yearly cost in india. Lets review the reasons behind car insurance rate increases. The average cost of a car insurance policy is 937 per year or 78 per month when averaged across states for our sample driver with a policy that meets the minimum requirements of each state. Get insurance premium quotes from carwale. Car insurance is required mainly for the following reasons.

The average cost of a car insurance policy with full coverage is 2390 per year or 200 per month. A third party liability policy is compulsory for all vehicles but you can decide to go for a comprehensive car insurance policy too. Own damage premium depreciation ncb liability premium. Buy or renew your car insurance policy.

If an insurance companys claim payout total exceeded its premium revenue it will often pass on those costs to customers the following year. Calculate auto insurance premium in india. Hdfc ergo car insurance is a trusted motor insurer in india that offers third party liability plan standalone own damage plan as well as a comprehensive car insurance plan. With united india car insurance being one of the oldest insurers in india having been set up in 1938 listed below are some of the key benefits of availing a car insurance policy from united india car insurance.

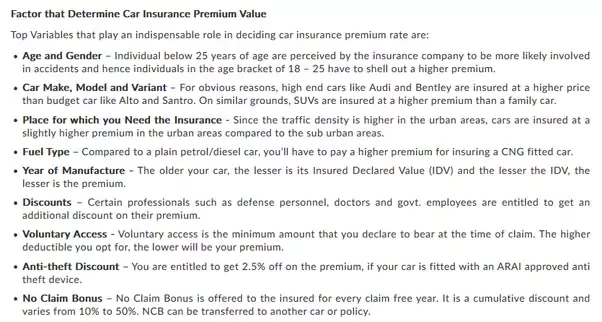

Age and gender individual below 25 years of age are perceived by the insurance company to be more likely involved in accidents and hence individuals in the age bracket of 18 25 have to shell out a higher premium. The premium for your car insurance depends on the below mentioned factors. Now irdai has asked insurers to provide a minimum cover of rs 15 lakh under pac for owner drivers for both two wheelers and cars each at the premium rate of rs 750 per annum for annual policy. A car insurance premium calculator is a useful online tool to figure out the quotes of different insurance companies in india.

Top variables that play an indispensable role in deciding car insurance premium rate are. On average car insurance premiums increased by 2 between 2018 and 2019 the most recent year for which data was available. The premium charged for two wheelers and cars was rs 50 and rs 100 excluding the taxes respectively. It offers the feature of overnight car repair services and boasts one of the largest networks of cashless garages in india.