Car Insurance Vocabulary

The insurance covers losses to the insureds property and losses for which the insured is liable as a result of owning or operating a car.

Car insurance vocabulary. Keep in mind that deductibles and premiums are related. Flat cancellation is the cancellation of a policy as of its effective date without any premium charge. To put it another way a high deductible can save you money every month. With accident forgiveness not available in ca ct and ma on your geico auto insurance policy your insurance rate wont go up as a result of your first at fault accident.

A statistician who computes insurance risks and premiums. A high deductible means a low premium. If your insured vehicle collides with another object collision coverage pays for the damage to your vehicle. Also a low deductible means a high premium.

That is any person who asserts right of recovery. Car insurance provides protection from losses resulting from owning and operating a car or vehicle. The fair market value of property. Classic car insurance covers your collectible vehicle up to an agreed value decided by you and your insurance company.

A form of insurance that protects against losses involving cars. In the event of a total loss the insurance company makes payment to the loss payee first. An insured individual or a beneficiary who receives a loss payment from an insurer. Collision coverage may extend to a non owned car or one rented for personal use that is in your custody or that youre operating.

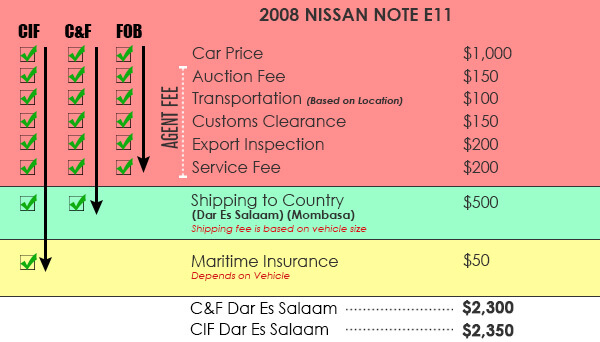

On an auto insurance policy a loss payee is the institution that financed the loan or lease of the vehicle. Usually though car insurance deductibles are between 0 and 1500. Claim notice to an insurer that under the terms of a policy a loss maybe covered. If your vehicle is valued at 20000 but your auto loan totals 25000 then you have a 5000 gap that would be owed to your finance company if the car were totaled.

Auto insurance coverage can help to provide medical payment for treatment of bodily injury comprehensive coverage insurance designed to pay for the repair or replacement of the policyowners car in the event of damage not resulting from an accident. The termination of insurance coverage during the policy period.