Car Insurance Graph

Geico has the cheapest car insurance rates in arizona according to our study of costs for a full coverage policy from the top insurers in the state.

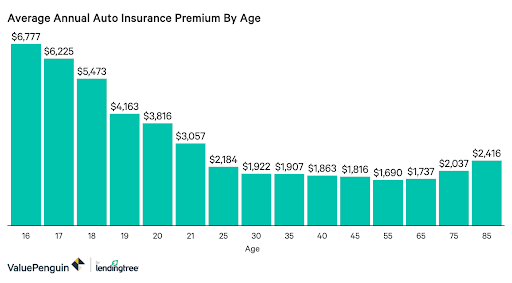

Car insurance graph. Keep out of trouble always drive the speed limit keep a good credit score and avoid risky behavior and your rates will remain lowgetting married also helps as does sticking with the same carrier for years. In 2019 car insurance for a 25 year old driver in the united kingdom uk was around 25 percent more expensive than for a driver in his 30s. A graph representation of insurance fraud in this case graph database queries can be added to the insurance companys standard checks at appropriate points in time such as when the claim is filed to flag suspected fraud rings in real time. Of course auto insurance comes at a cost to the car owner and the younger the owner the more expensive car insurance typically is.

6 includes loss adjustment expenses. Download high quality insurance clip art from our collection of 41940205 clip art graphics. Download this premium photo about car insurance and car service. 4 claim frequency is claims per 100 earned car years.

Drivers can now expect to pay 809 for a typical comprehensive car insurance policy on average. The below car insurance comparison chart shows the top us car insurance companies to compare side by side with easy to compare statistics like the year the company was founded the companys am best financial strength rating us market share as well as a link to a full car insurance company review. 77847 insurance clip art images on gograph. 3 excludes massachusetts michigan and new jersey.

Line graph with stack of coins and toy car business and financial concept and discover more than 4 million professional stock photos on freepik. In 2018 the average cost of car insurance for 19 year old males. The graph below depicts how the above scenario might be modeled in a graph database. This is the steepest annual increase in prices in more than two years.

Costs varied city by city in arizona as well as company by company. 2 excludes massachusetts and most states with no fault automobile insurance laws. 5 claim severity is the size of the loss.