Auto Insurance Terms Defined

Auto repair xpress.

Auto insurance terms defined. A request for payment from your car insurer to cover vehicle repairs injury treatment or other costs. Geico program that maximizes convenience. Term final expense and permanent. There are a few common types of life insurance.

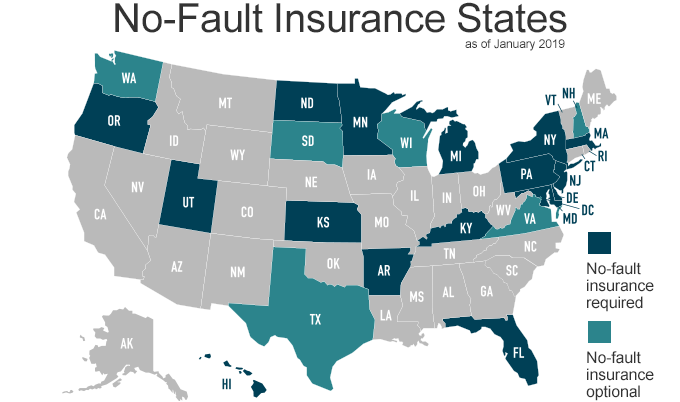

Car insurance provides protection from losses resulting from owning and operating a car or vehicle. We are covering these two provisions separately because theyre often confused. What every driver needs to know auto insurance basics. In the event of a total loss the insurance company makes payment to the loss payee first.

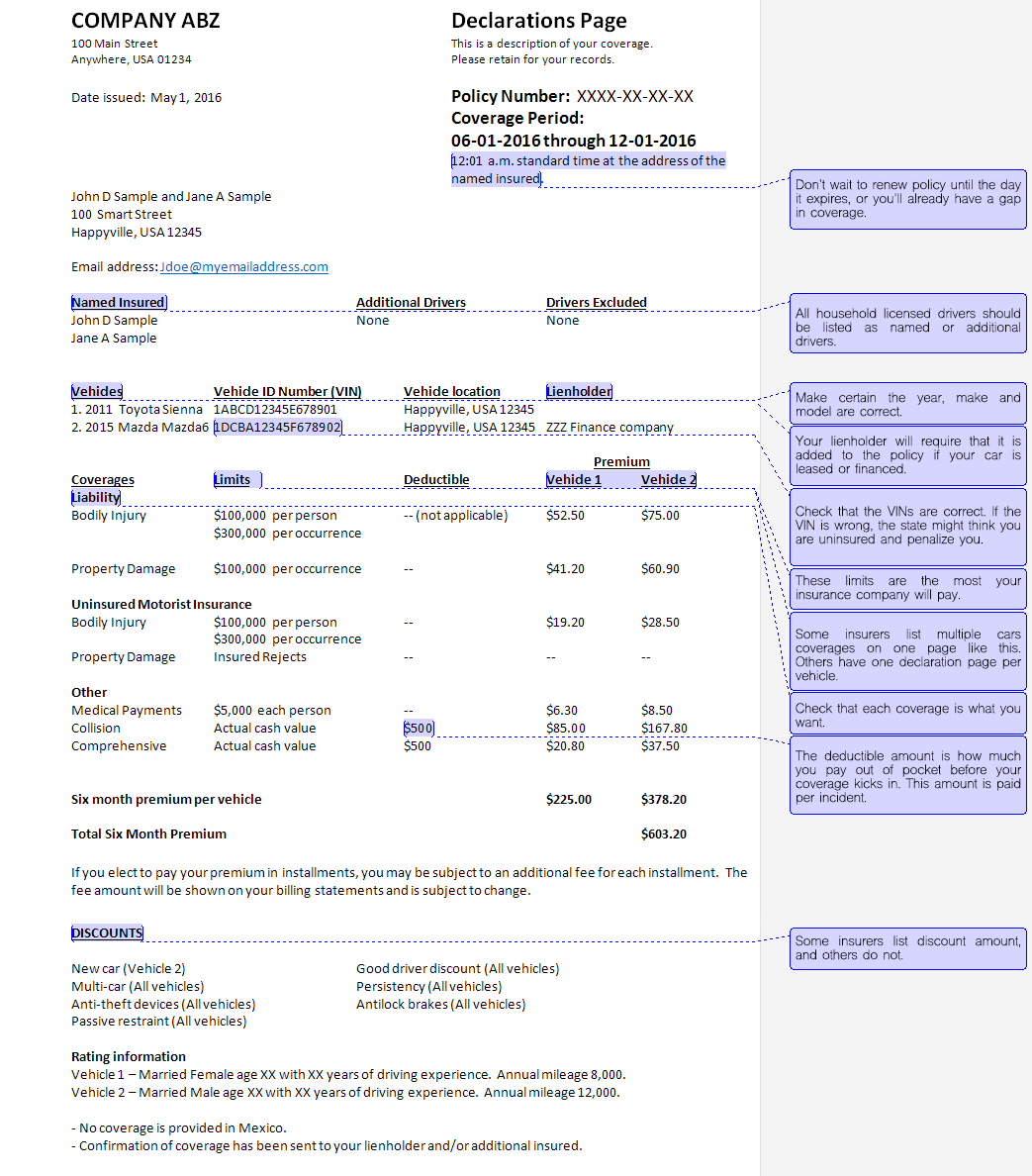

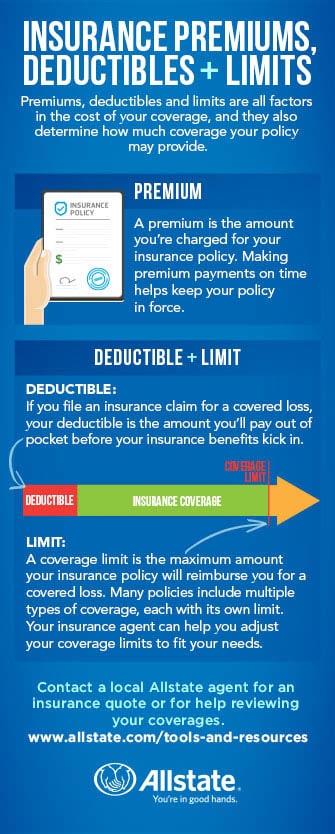

See more on the different types of life insurance. An insured individual or a beneficiary who receives a loss payment from an insurer. An insurance coverage limit is selected by you and is the most an insurance company will pay for damages injuries or losses that apply to the coverage. The insurance covers losses to the insureds property and losses for which the insured is liable as a result of owning or operating an auto.

While you dont need an auto insurance terms glossary to understand the meaning of a limit it has a specific meaning in the context of your vehicle coverage. Property damage to or theft of your car liability legal responsibility to others for bodily injury or property damage medical costs of treating injuries rehabilitation and sometimes lost wages and funeral expenses. The insurance covers losses to the insureds property and losses for which the insured is liable as a result of owning or operating a car. There are six basic provisions in a typical auto insurance policy.

Auto insurance provides protection from losses resulting from owning and operating an auto. In addition to the specifying your premium and deductible each policy sets a limit for the maximum amount your insurance company will pay for a specific claim.

/two-men-arguing-about-damaged-cars-90201066-57e0914f3df78c9cce0d23c3.jpg)

/male-customer-eyeing-new-car-in-car-dealership-showroom-922707384-5c51a2cac9e77c00014afe1e.jpg)

/GettyImages-1141164585-5486d44770c94a2784185a75be37a6fa.jpg)

/diminished-car-value-after-accident-2645571_FINAL-03d5b82f0c704c01a43a92a610f1fc3f.png)

/GettyImages-1046962266-0b6ad07942ee44b48ce02b111ee7d820.jpg)

/GettyImages-958707514-5c326ccac9e77c0001641850.jpg)

/damaged-bumpers-from-car-accident-1042683874-088a304b19ce499aba726943a378e257.jpg)

/people-helping-a-woman-after-a-car-accident-104304102-d7c7bec2c3bf45f78b16aa96f19427d9.jpg)

/GettyImages-1012103542-a527d1f380024d5b87c02b255c1d4049.jpg)

:max_bytes(150000):strip_icc()/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg)

/GettyImages-941132094-04368c13d238481d9212f34d1658f271.jpg)

/GettyImages-1053743626-3b1327252ce94a998c9508c06fed8eea.jpg)

.jpg)