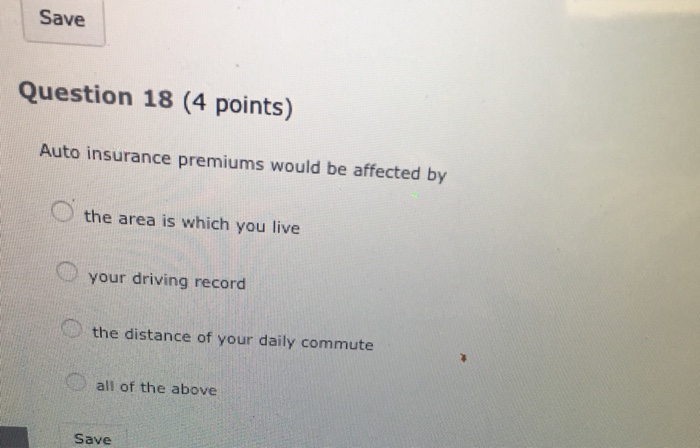

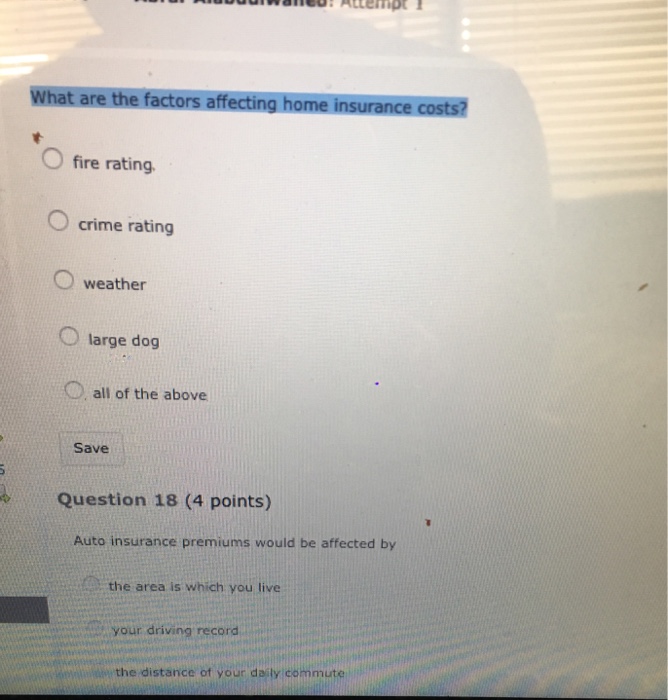

Auto Insurance Premiums Would Be Affected By

This can work in two ways the first way is pretty straightforward the second way is a little more complicated but a good way to save on your insurance premiums.

Auto insurance premiums would be affected by. An auto insurance premium is the total cost of maintaining your car insurance policy. Different car models are grouped together based on their price when new performance repair costs and the price of body shell and replacement parts. Insurance commissioner ricardo lara ordered insurance companies to return insurance premiums to consumers and businesses and provide much needed financial relief during the covid 19 emergencythe commissioners bulletin covers premiums paid for at least the months of march and april including the month of may if shelter in place restrictions continue in at. Auto insurance companies use many factors to set the cost to insure a car.

The current age and value of your car affects your insurance premium plus the insurance group that the car is in. Whether you are purchasing life insurance car insurance health insurance or any insurance you will always pay more premium more money for higher amounts of coverage. The insurance group process also looks at safety features like locks and alarms to determine. Credit based insurance scores which rely on using an individuals credit history as a factor in determining a premium affect many different lines of insurance from home to auto.

Changing the deductibles on your policy impacts what you pay in premiums and is one of the ways that drivers can manage the auto insurance rates and risks theyre comfortable paying. Here is a list of 22factors that affect auto insurance premiums. How your car affects your insurance. From the type of car you drive to your age and gender car insurance companies use a variety of factors when determining your premium amount.

According to the insurance information institute auto insurers will be giving back a total of 105 billion in premiums and benefits. The amount of the deductibles is inversely proportional to the premium so increasing your deductibles will lower your rates and vice versa. In our analysis well show how varying deductibles can save.