Auto Insurance Premiums By State

State farm the countrys largest auto insurer said thursday it would give policyholders an approximate 25 credit on premiums paid between march 20 and may 31.

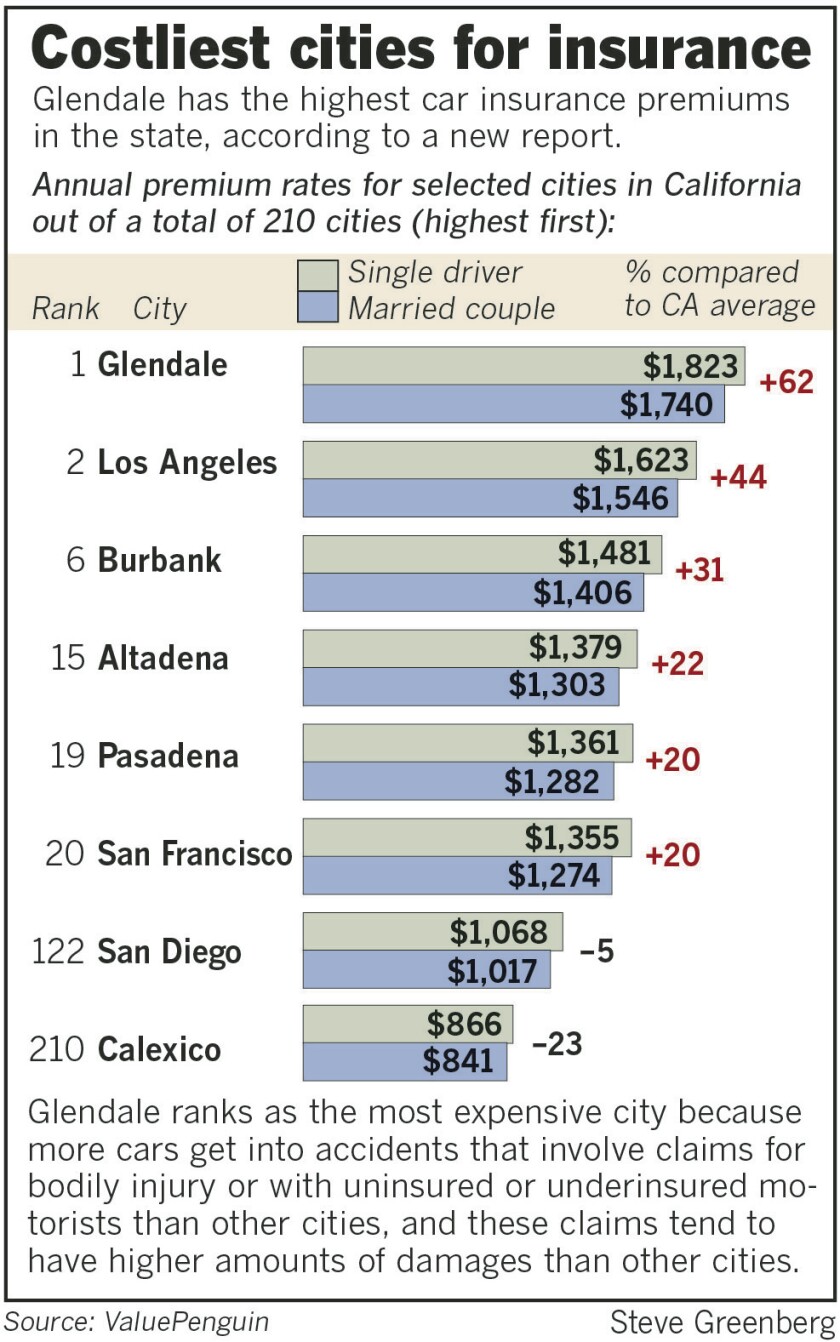

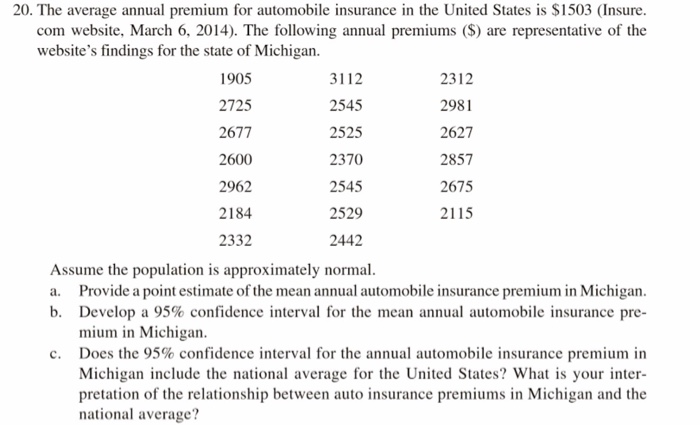

Auto insurance premiums by state. Now more than 82 of auto insurance companies like state farm geico and liberty mutual are offering policyholders refunds and credits to save money totaling more than 65 billion over the next. The state most widely. Another reason is that your location is chief among the factors car insurance companies use when setting rates. As an example michigan uses a unique no fault insurance system that in many ways is responsible for its high premiums.

As the nations largest auto insurer state farm. State required insurance minimums can also raise or lower insurance costs. State farm progressive latest to cut car insurance premiums the companies follow other insurers that are seeing reduced claims because the coronavirus has limited travel. Insurance commissioner ricardo lara ordered insurance companies to return insurance premiums to consumers and businesses and provide much needed financial relief during the covid 19 emergencythe commissioners bulletin covers premiums paid for at least the months of march and april including the month of may if shelter in place restrictions continue in at.

State insurance is a business division of iag new zealand limitedthis information is only intended as a guide. Every state has its own car insurance laws and thats one reason why car insurance rates rates by state vary dramatically across the country. Policy limits and exclusions apply. States set car insurance regulations and minimum insurance requirements which can have a major impact on the rates paid by residents.

2018 by state opinion on influence of zip code on car insurance. The credit from the countrys. Annual auto insurance premiums in the us. State farm declared it would provide an average credit of 25 on premiums from march 20 through may 31 though each states percentages will vary.

Based on the number and severity or cost of car insurance claims within the area. Please refer to the policy wording for full terms and conditions.