Auto Insurance Policy Life Cycle

Every insured driver that is involved in an auto accident needs to understand that there are commonly six elements of proof that most insurance carriers review and three stages in the auto.

Auto insurance policy life cycle. Insurance protects you against loss or injury due to accidents acts of nature theft and vandalism. Insurance policies provide protection against a range of unexpected circumstances including sickness an auto accident a house fire and flooding as well as for one ultimately expected experience. For all intents and purposes a life cycle policy is nothing more than another term for a whole life insurance policy. Auto insurance policy life cycle guide learn when to changeadjust car insurance coverage whether youre getting married buying a house or retiring its always a smart idea to talk to your local meemic agentwe can give you valuable guidance during major life changes including whether you should consider switching car insurance.

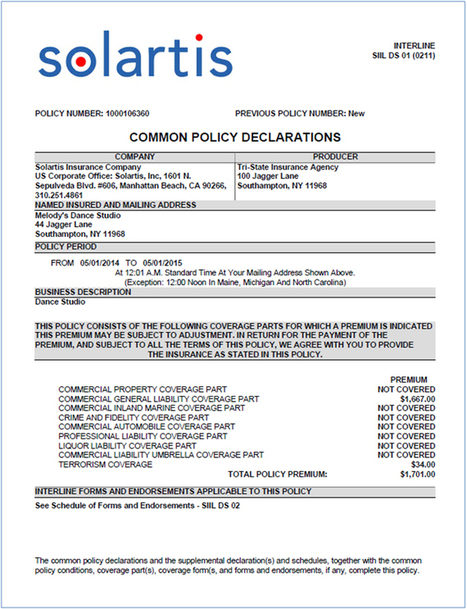

Knowing the life cycle of a claim. Then you trade your car in for a new one. Policy life cycle systems processes and procedures are all used by the staff responsible for policy processing. Esignature can be used with solartis insure policy life cycle services or can be integrated with any policy administration system.

A proposal submission of a policy a change or an endorsement can be made to a policy at any time. Here new policy processing includes all functions from new policy data capture through underwriting and rating to policy issue. Applications affidavits endorsement and cancellation requests. Ideally the policy pattern will follow a predictable schedule where the insurance policy is applied for when the person is between 30 and 50 at which time the person has achieved a degree of stability financially.

Esignatures can be obtained on newly generated or existing insurance documents. A submission is an application for insurance. Description of the life cycle of an insurance claim. Life cycle of an insurance policy.

For all insurance document types. Regardless of the kind of insurance you have or what company you use the basic procedure for filing a claim is similar.