Auto Insurance Limits By State

Auto insurance requirements in alabama.

Auto insurance limits by state. Have a look at the insurance required in indiana as well as a breakdown of what it covers. These minimum requirements for each state can be found at the state insurance commissioners website we have included them here for your easy reference just scroll down to your state and check it out. In lieu of auto insurance individuals can either 1 deposit 10000 in cash stocks or bonds with the state treasurer who will issue a receipt or 2 obtain a motor vehicle liability bond equal to the state minimum limits. State required insurance minimums can also raise or lower insurance costs.

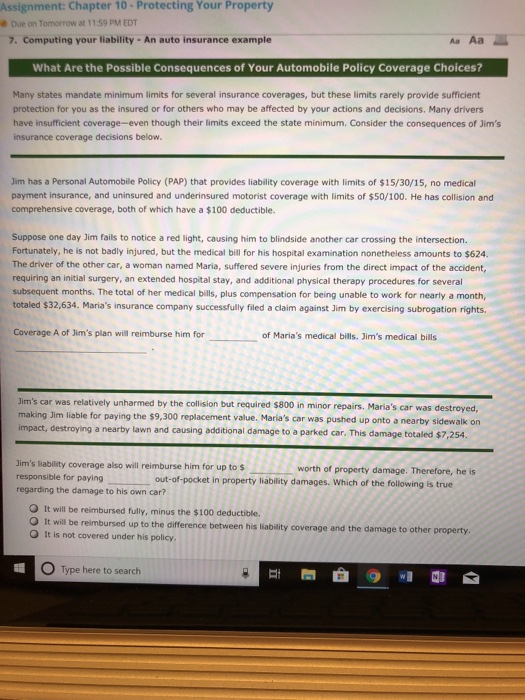

Many states require pip sometimes as part of no fault auto insurance laws. No fault laws limit your ability to sue someone for. Car insurance requirements for all 50 states. If so your liability car insurance coverage may change due to the recent increase in minimum limits approved by the state which will be valid starting july 1 2020.

Known as a mandatory minimum drivers must purchase and maintain a certain level of car insurance from an insurance company in case of an accident or injury to another person or property. If your liability limits are for 255025 this correlates to 25000 of bodily injury coverage per person injured in an accident 50000 of total bodily injury coverage per accident and 25000 for the property damages. The limits that you choose are the maximum amount of money per accident that your auto insurance company will pay. State minimum insurance requirements are the car insurance requirements for each state by law for their residents.

You need to meet the minimum amount of car insurance requirement based on the state you live in meaning your permanent address. But variations in state laws can make pip tricky to pin down. If you move out of state you might need to add additional car insurance coverage to your policy based on your new states requirements. Heres everything you need to know about the new state law so you can avoid penalties due to a lack of coverage.

For example if the limit on your collision coverage is 20000 that is the most that your policy would pay out for damages to your vehicle after a collision. Car insurance coverage limits are maximum amounts of money that your car insurance will pay out if you make a claim. As an example michigan uses a unique no fault insurance system that in many ways is responsible for its high premiums. If you plan on driving in the state of alabama the alabama mandatory liability law requires drivers to carry insurancefurthermore drivers must also carry proof of insurance while drivin g which must be shown to law enforcement officials when requested.