Auto Insurance Liability Limits By State

There are three main limits of liability insurance in an auto policy which youll often see summarized by three numbers.

![]()

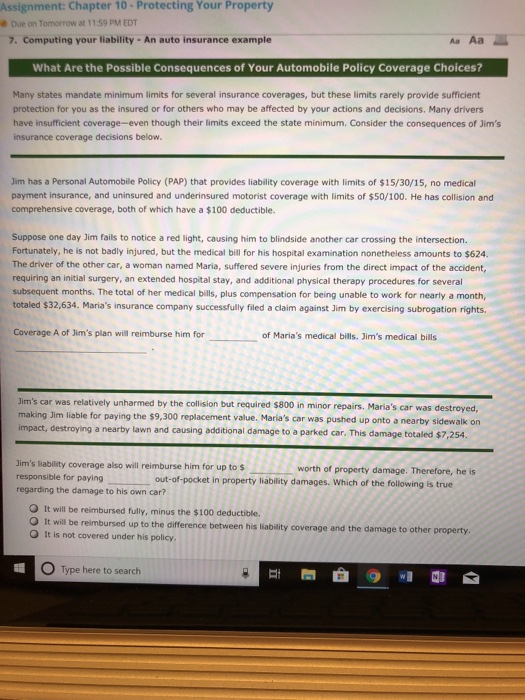

Auto insurance liability limits by state. Heres all you need to know about auto insurance liability limits. If you are looking for basic car insurance required by your state you will most likely only need liability insurance which will cover bodily injury and property damage if an accident occurs. Youll often see limits written using two or three numbers such as 2550 or 255020 especially when you see state required minimum limits. These same numbers may also be expressed as 200004000015000.

Thats why it may be a good idea to increase your auto liability limits above the states minimum requirements by purchasing more coverage. 15000 per accident for property damage. Auto insurance liability limits vary by state. Bodily injury liability coverage this type of coverage often referred to as bi coverage pays for the costs associated with injuries for which you are legally liable.

Most states have minimum requirements for liability insurance which pays for the other drivers injuries and those of his passengers as well as vehicle damage to his car. Every state in the nation except for new hampshire requires you to have liability insurance. In alabama for example the minimum requirements are 25000 of bodily injury liability for one person. Coverage limits are displayed like 154525 or 150004500025000.

You are at fault for a crash that injured three people in another car. State minimums can be around 200 while maximums can be 700. 20000 per person for bodily injury. For example you may see something like 306015 as your states minimum.

Geico 338 state farm 454 nationwide 523 progressive 552 farmers 659 allstate 667. The numbers represent the limits in your car insurance policy for example. There are two types of liability car insurance that companies like state farm offer and each covers different items. Your bodily injury liability limit per person is 50000 and your bodily injury limit per accident is 100000.

State minimums can be around 200 while maximums can be 700. Minimum car insurance requirements vary from state to state. This means the car insurance coverages and limits that work for a friend or family member living elsewhere might not be right for you. If the numbers are 204015 then you have.