Auto Insurance History Report

It will depend upon what type of auto insurance history you are trying to obtain as to how you would go about getting it.

Auto insurance history report. It aims to reduce the number of vehicle crashes the rate of injuries and amount of property damage. Most homeowners and auto insurance companies contribute claims history information to a database known as the comprehensive loss underwriting exchange clue which is available from lexisnexis. They are one of the best ways to learn about a given vehicles past and help make your search for a used car much easier. For example if you have a driver history riddled with moving violations and license suspensions an auto insurance company might insure you at higher premiums than it would insure someone with a cleaner record.

In any case you can run our free vehicle history report to know a cars full story. Car insurance companies use your motor vehicle report to determine their risk in insuring you. Print and complete the request form by clicking on the autoplus request form or hits request form links below. Vehicle history reports have become an integral part of any used car purchase.

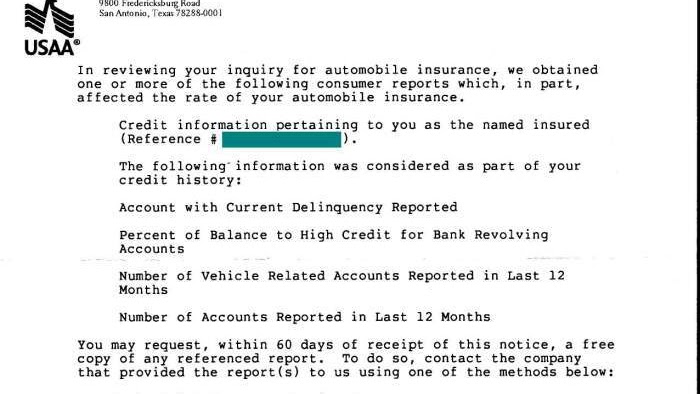

When you purchase a new car insurance policy youll typically be required to provide details about you and your car including information about any previous claims. Once the record is made only the insurer that submitted it can make changes. A loss history report is a record of insurance losses associated with a home or a car. After you file an auto insurance claim the claim will become an official entry on your claims record.

Also called an autoplus report your insurance history includes information about your most current insurance policy as well as insurance claims if any for the past 20 plus years. If you are moving abroad or changing states and think that by having an auto insurance history to show to a new insurer you could lower your rates you would need to ask your current insurance provider if they can print you out a history of your auto insurance coverages and. Consumer property information is provided in a consumer hits report. It details the type of claim eg.

Heres how to order your auto claims history report from cgi. Your claims history is a record of every car insurance claim you have made on your policy in the past. It doesnt matter if the claim was settled for 200 or what type of claim it was the claim is notated in your personal driving record so that insurers can use the information reported for underwriting purposes. Car insurance is mandatory in canada regardless of whether youre driving a personal vehicle or renting one.

Iihs is a nonprofit organization funded by auto insurance companies. Collision theft bodily injury how much was paid out and in the event of a collision the percentage of fault assigned. Iihs conducts its own testing program and issues its own ratings. This is to ensure that in case of any automobile accident driver can cover the cost of damages to people or property.