Auto Insurance Explained For Dummies

If you are your insurance is going to have to pay for bodily injury liability property damage liability coverage personal injury protection medical payments coverage the combination of these coverages is the most basic form of of an auto insurance policy.

Auto insurance explained for dummies. Part of insurance for dummies cheat sheet. Car insurance isnt the simplest thing in the world and there are a lot of details that you should learn. There are two main ownership costs to consider. Car insurance for dummies.

In the event of hail damage or a tree limb falling on your car risks not involving an automobile collision this coverage insures you. Definitions and terms explained when you are new to the car insurance scene you might have a lot of questions. One of the key decisions in deciding what car to buy is assessing how much all the other costs are that come with ownership. The purchase price andor the car payments are just the most obvious of costs.

By jack hungelmann. So if in 20 years your kids will be out of college and your mortgage will be paid off then a 20 year term policy for those. Getting a cover for your car is very important. If youre in an automobile accident regardless of who is at fault collision insurance provides protection to replace or repair your vehicle subject to a deductible.

Some auto insurers however are now offering supplemental insurance products at additional cost that extend coverage for vehicle owners providing ride sharing services. Once you get older the need for life insurance changes. Understanding car insurance policy for dummies car insurance is a cover that is provided for all types of cars ranging from trucks passenger cars and suvs. But for your insurance company and that of any other people involved carry a copy of the following list in your glove compartment so that you get all the information you need to protect yourself and expedite your.

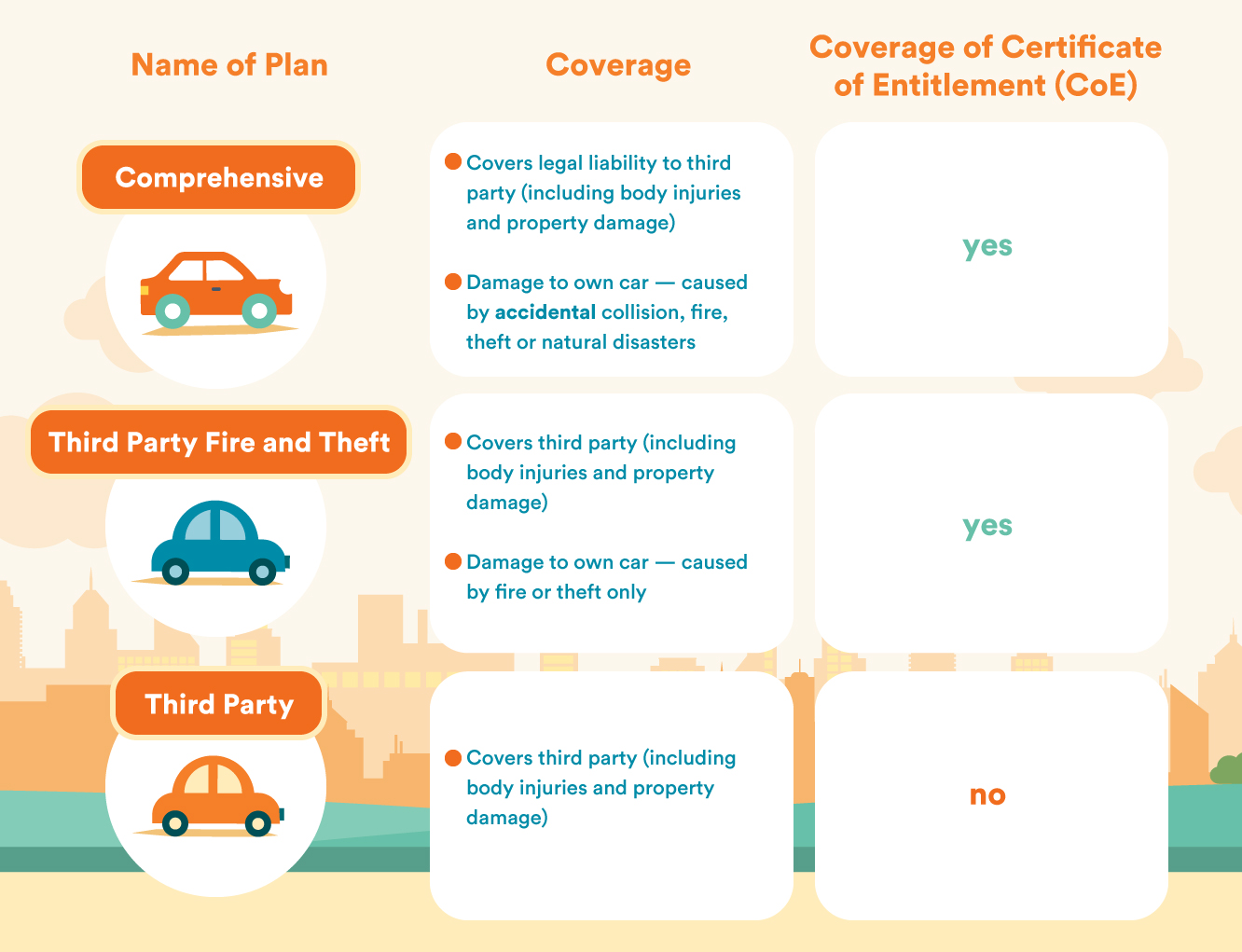

Comprehensive coverage pays to repair your vehicle subject to. The importance of having insurance for your vehicle is to act as a guarantee that in case the worst ever happens you and your car will be coveredprotected by the insurance company. Check out this handy infographic on the types of required and optional drivers insurance coverages. Basically term life insurance is good to protect against temporary financial risks like a mortgage your kids college tuition etc.

Life insurance for dummies. In this video im going to walk you through the exact steps to figure out how much car insurance you need.