Auto Insurance Deductible When Not At Fault

Its one of the most common car insurance questions and may be the easiest to answer.

Auto insurance deductible when not at fault. Depending on the coverages you add to your policy you could have one or several deductibles. If you arent at fault in an indiana car accident there are two ways you can recover damages. Heres how subrogation works in car insurance. Your insurance company will pay for your damages minus your deductible.

How ma auto insurance deductibles work. In case youre new to car insurance deductibles or just want a refresher lets first reestablish what they do. Often dcpd coverage has a 0 deductible. This means the deductible will not apply if another driver is at fault and can be identified.

Deductibles generally apply when the damage to your vehicle is your own fault. The at fault drivers insurance company so that the not at fault driver gets their deductible back. When youre not at fault for a car accident claims typically fall under the direct compensation property damage dcpd coverage on your insurance policy. This is most helpful when there is an uninsured identifiable driver.

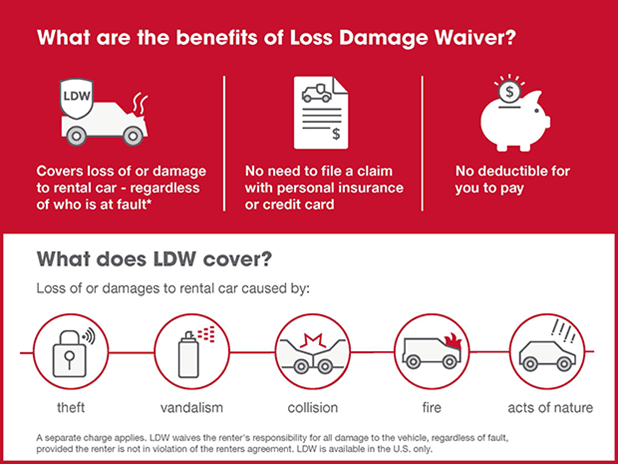

There is an option for a waiver of deductible. Your insurer determines youre not at fault so they cover. Lets look at an example. You do not have to pay your deductible if you are not at fault for the car accidentthat being said you might want to pay your deductible and file for damages with your own insurance company instead of filing with the at fault drivers insurance.

And not all coverages have deductibles. Filing a claim with your insurance company. If your insurance policy has a 0 deductible for dcpd claims you wont need to pay a deductible. Car insurance deductible at fault.

So if you are in an accident and your deductible is 500 you must pay the first 500 and your insurance will pay the rest up to the limits of your policy. For instance if you have a 500 deductible and 3000 in damage from a covered accident your insurer would pay 2500 to repair your car. A deductible is the amount you are required to pay out of pocket before your insurance will pay for damage to your vehicle or injuries sustained in an accident. An auto insurance deductible is what you pay out of pocket on a claim.

If you are found to be 100 at fault for the accident you will be required to pay your deductible in full. Your deductible is the out of pocket amount you agree to pay when you file a car insurance claim. This means that if youre not at fault and dcpd coverage applies the damage will be completely covered by your insurer and you wont have to. You live in ontario and another driver rear ends your vehicle on your way to work.

American family receives money from another insurer eg. Basically subrogation is when one insurer eg.