Auto Insurance Deductible Reimbursement

Understanding the role deductibles play when insuring a car or home is an important part of getting the most out of your insurance policy.

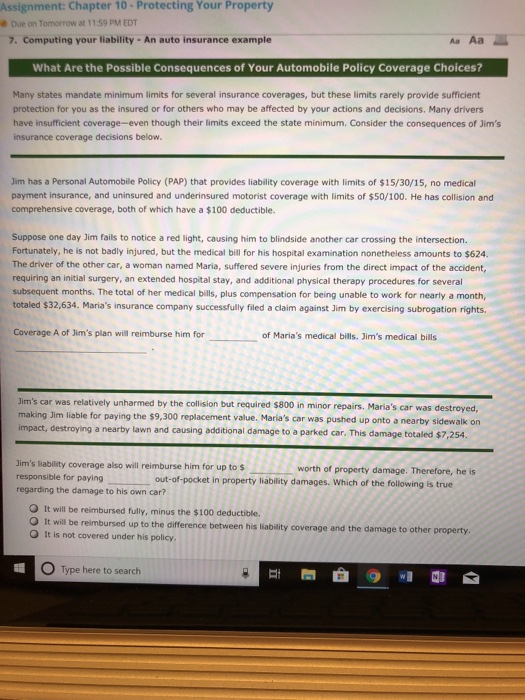

Auto insurance deductible reimbursement. A deductible is the amount of money that you are required to pay out of pocket before your expenses are paid on a claim. A deductible is commonly required with collision coverage which is coverage that would. Pays up to 500 when claim is filed and paid with primary insurance carrier. A deductible reimbursement solution is designed to reimbursement the out of pocket deductible to the consumer when they have a covered claim with their auto insurance carrier that exceeds the deductible amount.

Pays up to five hundred dollars 500 per loss unlimited losses per year when a loss is filled and paid by the auto insurance company for a covered auto the member owns or leases evidenced by the title or registration and insures under an auto insurance policy designating the member as the named insured. When you have an accident your car insurance. If you are in an accident and you have. You will pay 500your car insurance company will pay the remaining 2500.

Auto deductible reimbursement the auto deductible reimbursement benefit provides reimbursement for the deductible amount of your auto insurance policy in the event your vehicle is involved in a covered accident and the dollar amount needed to repair the damage exceeds your deductible. Youre responsible for your policys stated deductible each time you file a claim. A deductible is an amount of money that you yourself are responsible for paying toward an insured loss. Unlike health insurance there are no annual deductibles to meet when it comes to auto insurance.

For example if you total your car your insurer will give you a payment for the vehicles current value minus your deductible. 3000 of damage to your vehicle. What is a car insurance deductible. A car insurance deductible is the amount of money you agree to pay out of pocket when you file an insurance claim.

This solution is proven to enhance the value and increase the sales of retail products such as gap. Deductibles have been an essential part of the insurance contract for many years. Auto insurance deductible reimbursement this benefit reimburses you for up to 500 that you paid for an insurance deductible on qualifying accidents when the repair exceeds your insurance deductible subject to a limit of one benefit per year. Once you pay this amount your insurance company will then step in to help cover the remaining cost for damages up to your policy limit.

This involuntary benefit covers all automobiles that are owned and insured by the benefit holder. In the event your member suffers a loss on any motor vehicle they own and is insured under your members primary automobile insurance this coverage will reimburse the member for an amount equal to the deductible limit shown on your members current primary automobile insurance or 50000 whichever is less.