Car Insurance Medical Payments

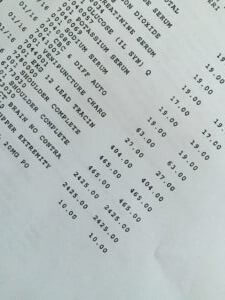

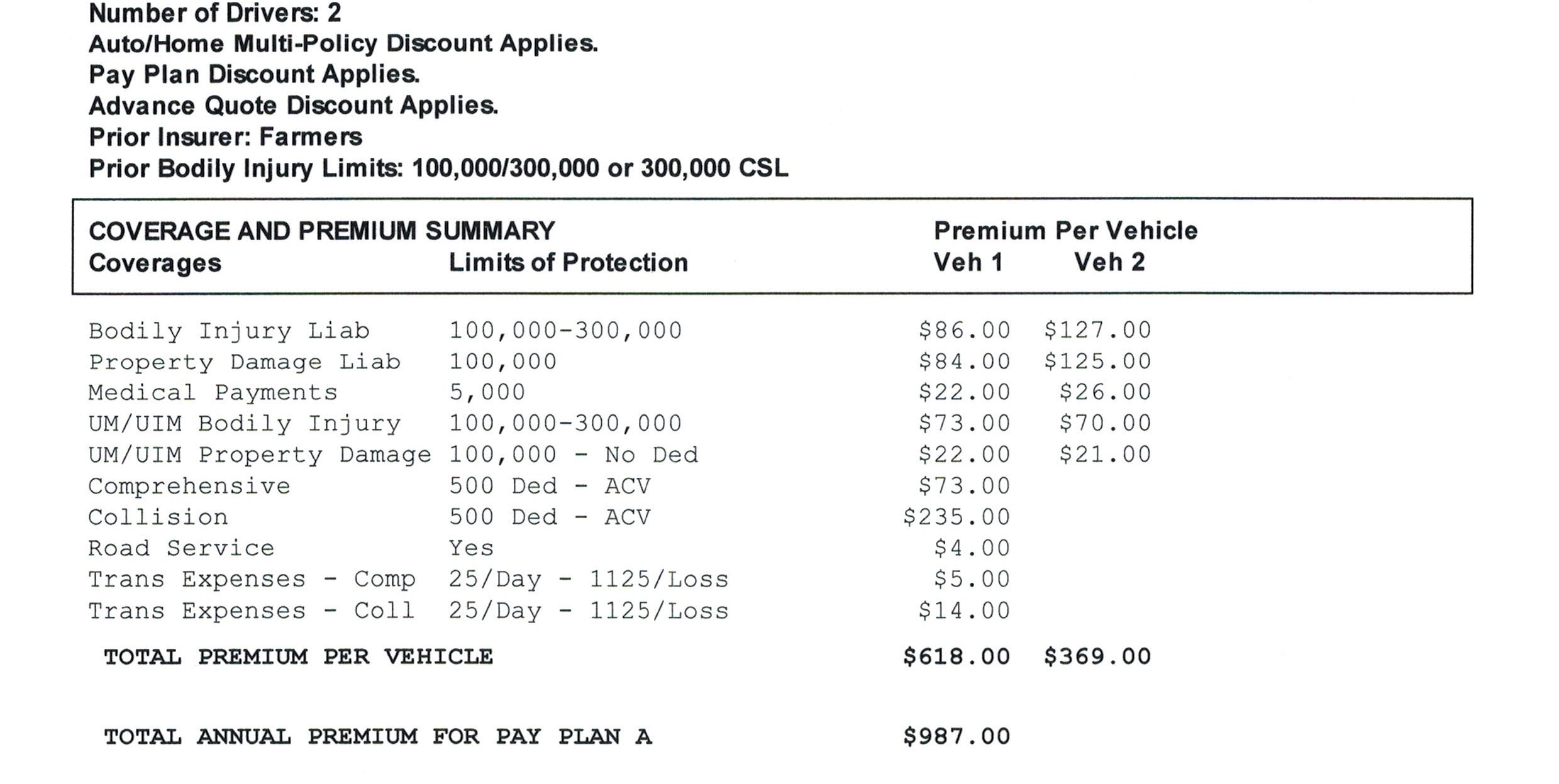

If the medical expenses exceed 5000 you will be back to paying out of pocket for medical costs.

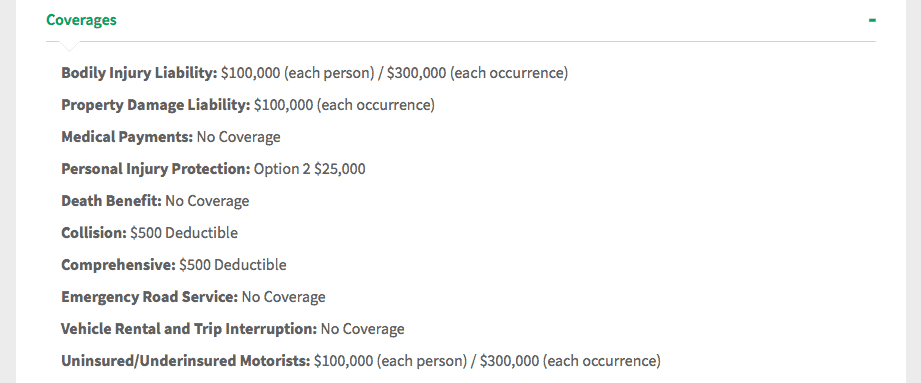

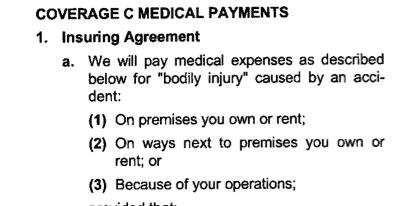

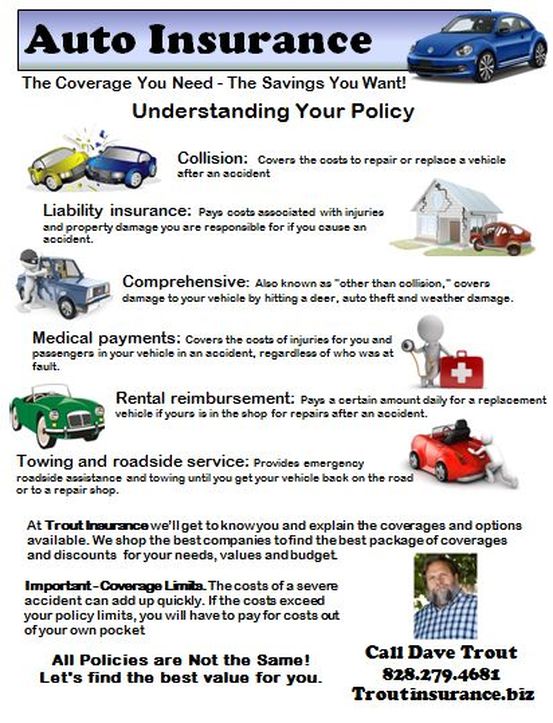

Car insurance medical payments. As with any type of car insurance the higher the limit you purchase the more coverage you will have. Thats where medical payments coverage on your car insurance policy may help. Injuries sustained by your passengers. Medical payments insurance helps cover medical expenses associated with auto accidents.

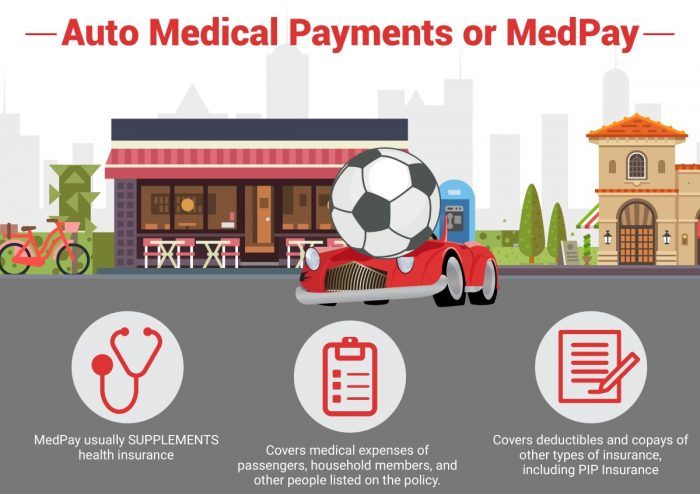

Additionally medical payments insurance may help pay for. The positive side to med pay is that it is not dependent upon who is at fault. Some states that adhere to the traditional fault system still require pip unless its declined in writing. It also pays the.

If you only purchase 5000 in medical payments coverage your policy will only pay out up to 5000 per person per accident. Medical payments coverage also known as med pay or mpc pays for medical bills and care due to an accident. What does medical payments cover. Liability coverageinsurance that helps pay for the injuries and damage to others from accidents that are your fault.

Medical payments coveragecovers limited medical costs for you or others in your car when you are in an accident. Limitthe most money that your insurance company will pay for your loss. Medical payments coverage in no fault states. In the states that offer or require no fault car insurance drivers policies typically include personal injury protection pip.

Medical payments coverage generally pays for medical costs after you are hurt in a car accident regardless of who is found at fault for the accident. It is an option available with auto insurance policies and usually covers expenses for the policyholder passengers and family members driving the insured vehicle at the time of an accident. Medical payments also known as medical expense or medpay coverage helps pay for medical and funeral expenses associated with auto accidents. Also called medpay it covers you and any passengers in your vehicle.

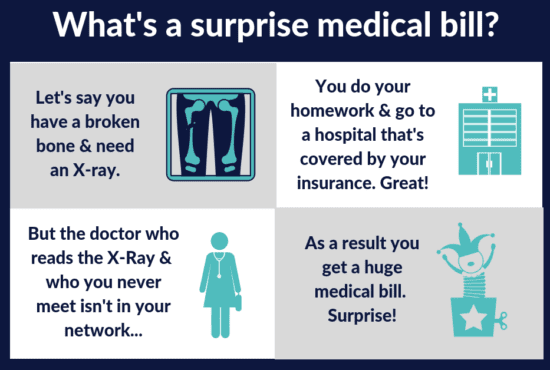

If you your passengers or any family members driving at the time of an accident are injured medical payments coverage can help protect youno matter whos at fault. Your health insurance might pay for some of the er visit but your health coverage may require you to pay a 2000 deductible and a co insurance payment for the emergency medical services.